.png)

Quantitative Outlook: International Equities and Silver Lead December

Welcome to our Quantitative Outlook, your monthly comprehensive guide to the latest trends and developments in Quantlake’s world of Exchange-Traded Funds (ETFs).

In December, we observed international equities and precious metals outperform, while U.S. large-cap and fixed income benchmarks delivered mixed results. Real estate and long-duration Treasuries faced renewed headwinds.

🔹 Equity Markets

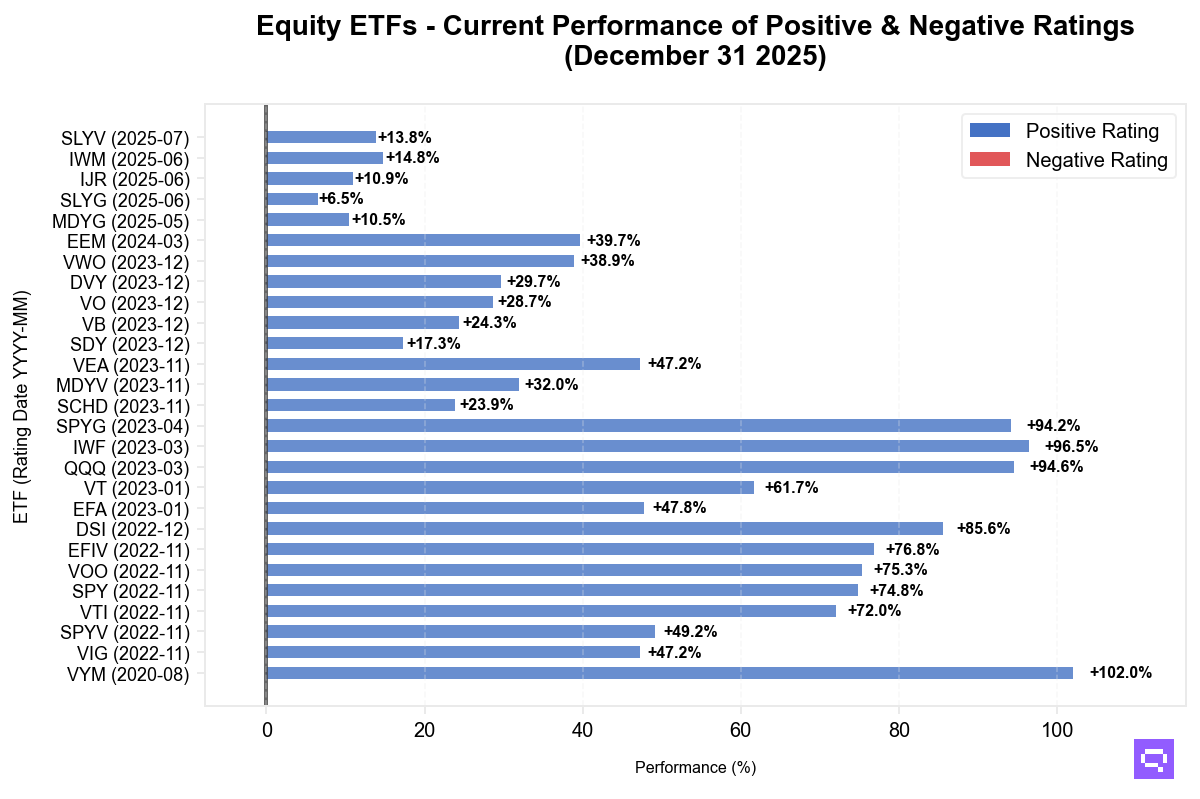

Equity ETFs closed December with broad gains across developed and emerging markets, while U.S. large-cap benchmarks posted muted returns. International exposures led, with Vanguard FTSE Developed Markets (VEA) and iShares MSCI EAFE (EFA) up 3.2% and 2.7%, respectively. Emerging markets also advanced, as iShares MSCI Emerging Markets (EEM) and Vanguard Emerging Markets (VWO) rose 2.2% and 1%. U.S. value and dividend strategies delivered mixed results; SPDR Portfolio S&P 500 Value (SPYV) and Schwab US Dividend Equity (SCHD) gained 0.4%, while Vanguard High Dividend Yield (VYM) and Vanguard Dividend Appreciation (VIG) declined modestly. Growth-oriented ETFs such as Invesco QQQ Trust (QQQ) and iShares Russell 1000 Growth (IWF) slipped by 0.7% and 0.6%. Small- and mid-cap segments were generally flat to slightly negative. All equity ETF ratings remain Positive, mirroring last month’s stable outlook.

🔹 Bond Markets

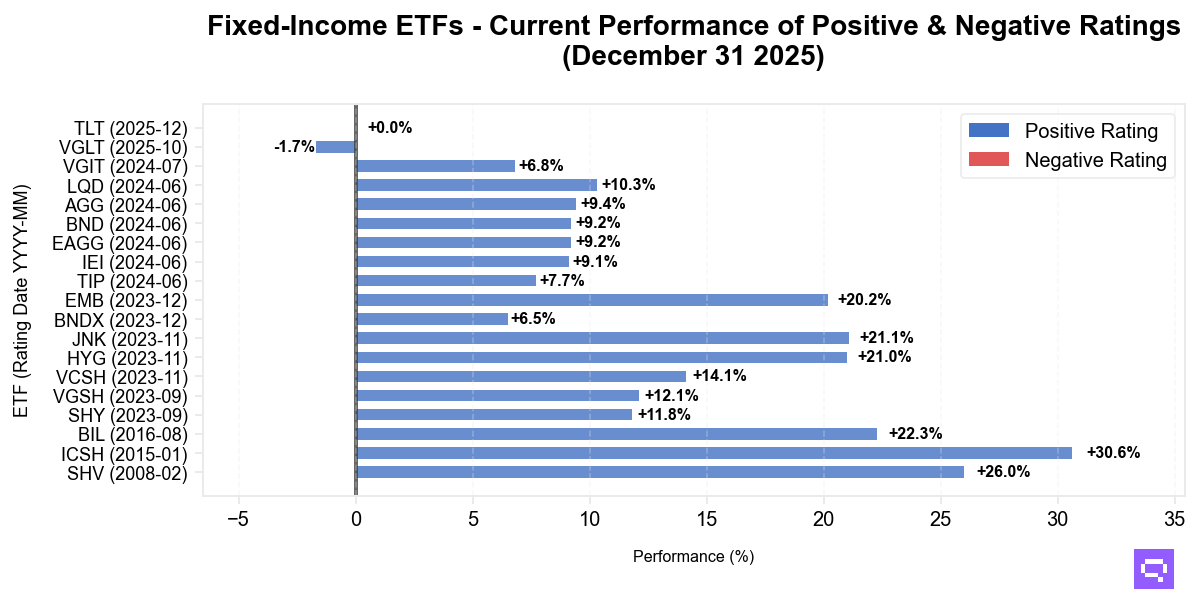

Fixed income ETFs delivered mixed results in December. Short-duration and ultra-short bond exposures, including iShares Short Treasury Bond (SHV) and BlackRock Ultra Short-Term Bond (ICSH), returned 0.4%. High yield corporates such as SPDR Bloomberg High Yield Bond (JNK) and iShares iBoxx $ High Yield Corporate Bond (HYG) posted gains of 0.6% and 0.5%. Core aggregate and investment grade exposures, including iShares Core US Aggregate Bond (AGG) and iShares iBoxx $ Investment Grade Corporate Bond (LQD), declined by 0.3% and 0.7%. Long-duration Treasuries underperformed, with iShares 20 Plus Year Treasury Bond (TLT) down 2.7% and downgraded to Negative. This contrasts with last month, when long-duration exposures held a Positive rating.

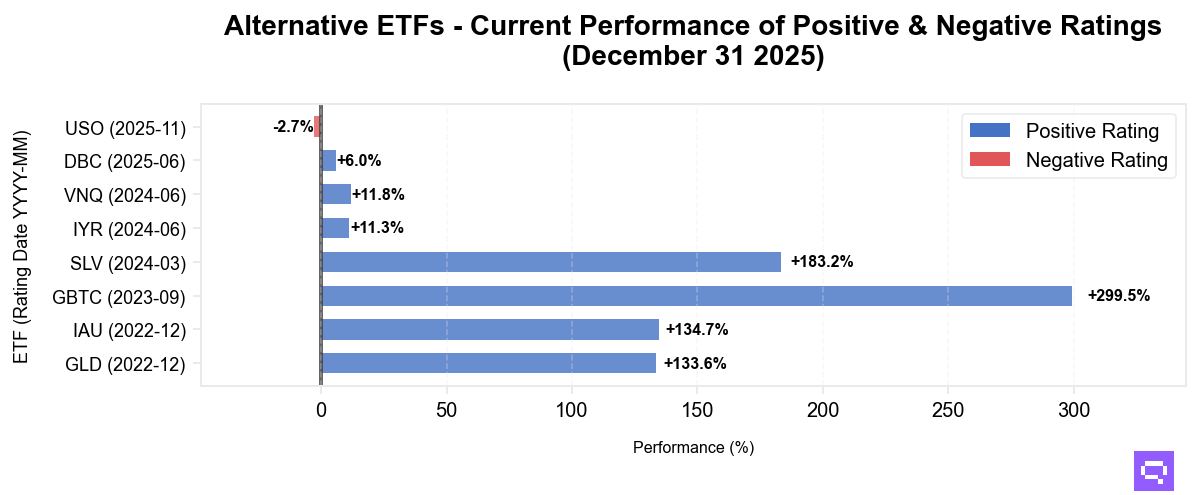

🔹 Alternative Assets

Alternative ETFs saw divergent performance in December. Precious metals maintained strength, with iShares Silver (SLV) surging 25.8% and gold ETFs (IAU, GLD) each up 2.2%. Grayscale Bitcoin Trust (GBTC) declined 3.7%, a narrower loss than in November. Real estate exposures, including Vanguard Real Estate (VNQ) and iShares US Real Estate (IYR), fell 2.2%. Broad commodities (DBC) were flat, while United States Oil Fund (USO) slipped 2.7% and remains rated Negative. Compared to last month, precious metals extended their lead, while real estate reversed direction.

Takeaways

The current landscape highlights the value of systematic diversification and disciplined rebalancing. Our approach remains grounded in patience and a long-term perspective, as asset class leadership continues to evolve.

Happy Long-Term Investing!

About Quantlake's Ratings

Our AI-powered ratings combine market trends, economic indicators, and unstructured data analysis. Updated monthly after the last trading day, ratings fall into two categories:

Positive: Optimistic outlook suggesting maintaining or increasing exposure

Negative: Cautious view indicating potential exposure reduction